Lorem ipsum

- dolor sit amet,

- consectetur adipiscing elit. Ut

- elit tellus, luctus

- nec ullamcorper mattis,

- pulvinar dapibus leo.

- Lorem ipsum

- dolor sit amet,

- consectetur adipiscing elit. Ut

- elit tellus, luctus

- nec ullamcorper mattis,

- pulvinar dapibus leo.

- Lorem ipsum

- dolor sit amet,

- consectetur adipiscing elit. Ut

- elit tellus, luctus

- nec ullamcorper mattis,

- pulvinar dapibus leo.

- Lorem ipsum

- dolor sit amet,

- consectetur adipiscing elit. Ut

- elit tellus, luctus

- nec ullamcorper mattis,

- pulvinar dapibus leo.

- Lorem ipsum

- dolor sit amet,

- consectetur adipiscing elit. Ut

- elit tellus, luctus

- nec ullamcorper mattis,

- pulvinar dapibus leo.

- Lorem ipsum

- dolor sit amet,

- consectetur adipiscing elit. Ut

- elit tellus, luctus

- nec ullamcorper mattis,

- pulvinar dapibus leo.

Author – Ken Hobson.

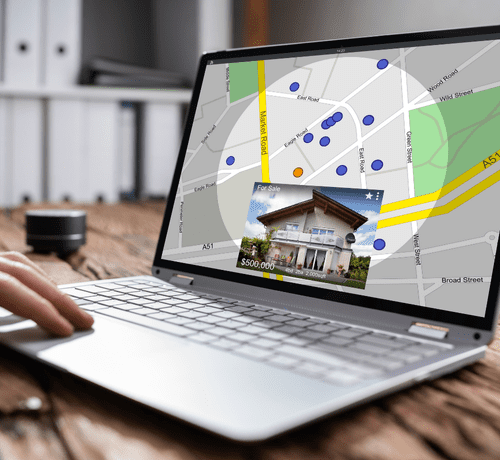

Knowing how many buyers or tenants will look for homes in each suburb helps you set prices, plan marketing and advise owners with confidence.

AI demand-forecasting models crunch thousands of data points to predict suburb-level demand weeks, months or even years ahead.

City averages hide big differences between neighbouring suburbs. One street can boom while the next stalls.

Pin-point forecasts let you time listings for peak eyeballs, choose the right advertising spend and spot growth pockets before competitors see them.

Landlords get clearer rent advice, and developers see where to build next.

Sales & rental history – volumes, median prices, days on market.

Online enquiry signals – listing views, saved searches, email enquiries. REA Group already feeds these into its own AI engines.

Demographics – population growth, incomes, household size.

Economic factors – interest rates, local job numbers, infrastructure projects.

Supply pipeline – DA approvals, new builds, vacancy rates.

| Model Type | How It Works in Plain English | Typical Use Case |

|---|---|---|

| ARIMA / Prophet | Looks at past ups-and-downs to project the next curve. | Quick monthly volume forecasts. |

| Random Forest & Gradient Boost | Compares many decision trees and votes on the best answer. | Explaining which features drive demand. |

| XGBoost / LightGBM | Faster, sharper tree ensembles that handle many suburbs at once. | State-wide portfolio forecasting. |

| LSTM (Long Short-Term Memory) | A neural network that remembers long trends and short shocks. | Weekly rental demand swings. |

| Temporal Fusion Transformer (TFT) | Combines LSTM memory with transformer attention so it “zooms in” on key dates and features. Delivers accurate, multi-step suburb forecasts. |

Collect data – pull at least three years of suburb metrics plus leading indicators like search traffic.

Clean & align dates – fill gaps, remove outliers and resample to weekly or monthly buckets.

Create extra features – school-holiday flags, interest-rate changes, days until auction season.

Split your data – train on the first 80 %, validate on the next 10 %, test on the final 10 %.

Train the model – start simple (Prophet), then try tree or deep-learning models if you have enough rows (10 k+).

Check accuracy – use MAE or MAPE; under 10 % error is usually actionable.

Deploy & update – automate weekly retraining to handle new market shocks.

CoreLogic SmartCharts – suburb sales, rent and listing forecasts inside RP Data.

PropertyPredictions.com.au – generates single-suburb growth reports using machine-learning models.

AWS Forecast – fully managed service; upload CSV, choose horizon, receive demand predictions via API.

DataRobot AI Cloud – drag-and-drop time-series modeller with explainable insights for non-coders.

Google Vertex AI Time Series – integrates BigQuery data and exports forecasts straight to dashboards.

Each tool can be used without code; most export charts or CSVs you can paste into your listing presentations.

Point forecast – single number, e.g. “34 buyer enquiries next month.”

Prediction interval – low and high bands show best-case and worst-case demand.

Feature importance – highlights which drivers (rates cut, new rail station) matter most so you can adjust strategy.

List properties just before predicted enquiry peaks to catch hunger buyers.

Advise sellers to price firmly when demand forecast dips.

Pitch landlords on rental increases in suburbs where tenant demand line slopes upward.

Target letterbox drops only in growth suburbs, saving marketing dollars.

Small sample sizes – a suburb with only a handful of monthly sales can trick the model.

Concept drift – sudden policy shifts or interest-rate spikes can break past patterns; retrain often.

Overfitting – a very complex model may fit history perfectly but fail on tomorrow’s data.

☐ Secure three-plus years of suburb data.

☐ Pick a baseline model (Prophet).

☐ Validate accuracy on hold-out months.

☐ Schedule weekly retrains.

☐ Visualise results in a dashboard for your team.

AI suburb-level demand forecasting turns raw data into clear signals you can act on—helping you list, price and market properties at just the right moment, with numbers simple enough to explain to any client.

AD SPACE – Bottom of Content

Lorem ipsum

- dolor sit amet,

- consectetur adipiscing elit. Ut

- elit tellus, luctus

- nec ullamcorper mattis,

- pulvinar dapibus leo.

- Lorem ipsum

- dolor sit amet,

- consectetur adipiscing elit. Ut

- elit tellus, luctus

- nec ullamcorper mattis,

- pulvinar dapibus leo.

- Lorem ipsum

- dolor sit amet,

- consectetur adipiscing elit. Ut

- elit tellus, luctus

- nec ullamcorper mattis,

- pulvinar dapibus leo.

- Lorem ipsum

- dolor sit amet,

- consectetur adipiscing elit. Ut

- elit tellus, luctus

- nec ullamcorper mattis,

- pulvinar dapibus leo.

- Lorem ipsum

- dolor sit amet,

- consectetur adipiscing elit. Ut

- elit tellus, luctus

- nec ullamcorper mattis,

- pulvinar dapibus leo.

- Lorem ipsum

- dolor sit amet,

- consectetur adipiscing elit. Ut

- elit tellus, luctus

- nec ullamcorper mattis,

- pulvinar dapibus leo.